COSO Committee of Sponsoring Organizations of the Treadway Commission

| Prev | Next | |

Chapter Summary

Every entity faces a variety of risks from both external and internal sources. Risk is defined as the possibility that an event will occur and adversely affect the achievement of objectives. Risk assessment involves a dynamic and iterative process for identifying and assessing risks to the achievement of objectives. Risks to the achievement of these objectives from across the entity are considered relative to established risk tolerances. Thus, risk assessment forms the basis for determining how risks will be managed. A precondition to risk assessment is the establishment of objectives, linked at different levels of the entity. Management specifies objectives within categories relating to operations, reporting, and compliance with sufficient clarity to be able to identify and analyze risks to those objectives. Management also considers the suitability of the objectives for the entity. Risk assessment also requires management to consider the impact of possible changes in the external environment and within its own business model that may render internal control ineffective.

Principles relating to the Risk Assessment component

6. The organization specifies objectives with sufficient clarity to enable the identification and assessment of risks relating to objectives.

7. The organization identifies risks to the achievement of its objectives across the entity and analyzes risks as a basis for determining how the risks should be managed.

8. The organization considers the potential for fraud in assessing risks to the achievement of objectives.

9. The organization identifies and assesses changes that could significantly impact the system of internal control.

| Principles | Approaches | |

|---|---|---|

| 6. The organization specifies objectives with sufficient clarity to enable the identification and assessment of risks relating to objectives. |

| |

| 7. The organization identifies risks to the achievement of its objectives across the entity and analyzes risks as a basis for determining how the risks should be managed. |

| |

| 8. The organization considers the potential for fraud in assessing risks to the achievement of objectives. |

| |

| 9. The organization identifies and assesses changes that could significantly impact the system of internal control. |

|

Principle 6. The organization specifies objectives with sufficient clarity to enable the identification and assessment of risks relating to objectives.

The following points of focus highlight important characteristics relating to this principle:

-

Complies with Applicable Accounting Standards—Financial reporting objectives are consistent with accounting principles suitable and available for that entity. The accounting principles selected are appropriate in the circumstances.

-

Considers Materiality—Management considers materiality in financial statement presentation.

-

Reflects Entity Activities—External reporting reflects the underlying transactions and events to show qualitative characteristics and assertions.

• Complies with Applicable Accounting Standards

• Considers Materiality

• Reflects Entity Activities

Management specifies objectives relating to the preparation of financial statements, including disclosures, and identifies significant financial statement accounts based on the risk of material omission and misstatement (which includes consideration of materiality). Management identifies for each account and disclosure relevant assertions, underlying transactions and events, and processes supporting these financial statement accounts. The entity uses financial statement assertions relevant to its financial statement accounts and disclosures.

As part of its risk assessment, the management of A-Middle Equipment, a 900-person manufacturer of heavy-duty transmission equipment, uses the following financial reporting assertions:

-

Existence

-

Completeness

-

Rights and obligations

-

Valuation or allocation

-

Presentation and disclosure

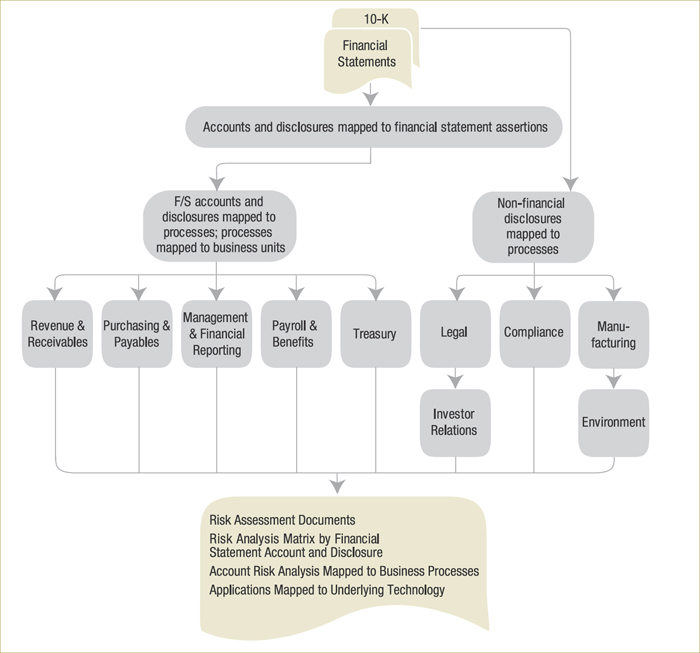

A-Middle's management considers the level of materiality when reviewing the company's activities and interim reports and determining whether all significant risks and accounts have been captured. This information is used as a guideline in focusing on detailed risks within each financial statement line item and disclosure. Further, management also considers non-financial disclosures reported in the company's 10-K. This approach is illustrated on the following page.

• Complies with Applicable Accounting Standards

Considers Materiality

Reflects Entity Activities

Management specifies a high-level financial reporting objective that forms the basis for all other sub-objectives. In specifying objectives, management has documented objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Management, as part of internal control, assesses whether the objectives are consistent with accounting principles that are relevant for that entity and appropriate in the circumstances.

Management and the board of directors of H2O To Go, a bottled water company, set as the entity's broad external financial reporting objective to prepare reliable financial statements in accordance with US Generally Accepted Accounting Principles (GAAP). Management subsequently specified the suitable financial reporting objectives and sub-objectives for all significant accounts and activities of H2O To Go's worldwide business, including sales, purchasing, and treasury. These objectives and sub-objectives include accounting policies, financial statement assertions, and qualitative characteristics relating to its accounts and activities. For instance, management has specified objectives relating to:

-

Sales existence and completeness financial statement assertions for all sales transactions recorded during the period fn 11

-

Purchasing completeness and accuracy of financial statement assertions for all purchasing transactions recorded during the period

-

Treasury valuation and allocation financial statement assertions for all investments held and recorded as of period end

Annually, finance management reviews these objectives and sub-objectives for ongoing relevance and suitability with respect to the company's accounts and activities. Where changes are expected to occur—for instance, the adoption of a newly published accounting standard or guidance or new commercial event or trend—appropriate management communicates the need to reconsider these objectives to those responsible for the objective-setting process.

The management of Valley Services, a supplier of high-end home theatre systems, set as the entity's broad financial reporting objective to prepare reliable financial statements in accordance with International Financial Reporting Standards (IFRS). This objective was cascaded into various areas of Valley Services business, including sales.

Within the sales process, management accepts deposits from one frequent customer, Hall Electronics, which relate to the purchase of several home theater systems. Valley Services sets aside the theater systems in its inventory until Hall Electronics requests delivery, usually within thirty days. Valley Service must either refund to Hall Electronics the cash or provide a replacement home theater system if a system is damaged or lost prior to delivery.

Management had previously established a policy where revenue was recognized upon payment for goods, regardless of whether the goods were delivered. In assessing the suitability of the objectives specified for financial reporting, the controller, Alex Robertson, determined that this policy may not be in accordance with IFRS. Consequently, he requested senior management to review this policy in conjunction with the objective-setting process. In addition, he advised the internal audit group, which then monitored the resolution of this matter.

Complies with Applicable Accounting Standards

• Considers Materiality

Reflects Entity Activities

Management assesses materiality of significant accounts, considering both quantitative and qualitative factors. In conducting this assessment, management may consider factors such as:

-

Who uses the financial statements (i.e., creditors, stockholders, suppliers, employees, customers, regulators)

-

Size of financial statement elements (i.e., current assets, current liabilities, total assets, total revenues, net income) and financial statement measures (i.e., financial position, financial performance, and cash flows)

-

Uniqueness of the transaction(s)

-

Difficulty in valuing the balance or specific transactions

-

Trends (i.e., earnings, revenues, cash flows)

The management of Bottomer Holdings, a private owner and renter of residential apartments, recently installed coin-operated laundry facilities in several of its buildings. A contractor installed and maintains the machines and will be paid a monthly amount plus a percentage of revenue earned through laundry services.

Looking at this new source of potential revenue relative to the income statement, Bottomer Holdings considered the effect on its total revenues and net income and has now concluded that the laundry revenue is expected to generate $150,000 to $200,000 of revenue per year.

Management has considered the overall materiality of this account using the quantitative measure of $500,000. Management also considered other qualitative factors and determined that this new source of income would:

-

Not change a loss into income—the company has been profitable over the past five years.

-

Not impact compliance with loan covenants and other contractual agreements—none of the mortgages on the buildings would require changes in loan repayment rates based on higher income levels.

-

Not impact management's compensation, including on-site property management staff—the additional income would have an insignificant impact on the management bonus plan.

Based on the assessment, management has concluded that the new source of income is not material to the overall financial statement presentation. Accordingly, in specifying its external reporting objectives, management has incorporated this new source of revenue into its overall revenue objectives as determined by Generally Accepted Accounting Principles but has not set out new, unique objectives for laundry-related revenue.

• Complies with Applicable Accounting Standards

Considers Materiality

Reflects Entity Activities

Management reviews publications from professional bodies for updates in accounting pronouncements relevant to the business. Periodically, management presents to the audit committee an analysis of changes released or emerging issues that may significantly impact financial reporting and notes any significant differences from accounting policies of similar entities. For entities that have multiple reporting obligations, such as statutory reporting in international locations, management assesses the requirements relative to the respective divisions or operating units.

Celia Mendez is the controller of a $100 million biotechnology company. She reviews its accounting principles by considering:

-

Policies selected that are acceptable according to the applicable standards (US GAAP)

-

Situations where multiple acceptable alternatives are available and the rationale for selecting one policy over another

-

Differences in its accounting policies from those of its peers

Management discusses significant accounting policies with the audit committee on an annual basis.

The management of Middle Ocean Inc., an $800 million industrial products company, regularly reviews the publications from professional bodies for updates in accounting pronouncements relevant to its business. The controller, Sandy Wong, and the CFO, Fred Jazbowski, also subscribe to and review periodic email updates on standards that may be of interest. Each quarter Ms. Wong presents to the company's audit and disclosure committees, which consist of key management members, her analysis of any changes that will immediately impact financial reporting, and any emerging issues that may impact financial reporting in the future. As part of her standard procedures and before any change is implemented, Ms. Wong also communicates to these two committees what impact any updated or new standard will have on the company's financial statements, systems, and processes.

Fred DeQuincy is the local controller of an international subsidiary of a multi-billion-dollar consumer products company. In his annual reviews of the accounting principles used for statutory reporting, Mr. DeQuincy considers the following:

-

Consistency with the company's consolidated accounting standards

-

Required differences as a result of the adherence to different standards

-

Where differences are required, the alternatives that are available and the rationale for selecting one policy over another

-

Where differences are required, identifying the policies selected by other companies within an identified peer group

Once he has completed his review, Mr. DeQuincy communicates the differences and the rationale for selection to the corporate controller.

Complies with Applicable Accounting Standards

Considers Materiality

• Reflects Entity Activities

Management, with the oversight of the audit committee, considers the range of the entity's activities to assess whether all material activities are appropriately captured in the financial statements. Management considers whether the presentation and disclosure of the financial statements enable the intended users to understand these material transactions and events.

Build Free Co. produces large-building products. The management of Build Free reviews its financial statements on a quarterly basis. The purpose is twofold:

-

To ensure all significant activities are included

-

To analyze its various business units for new and discontinued product developments and changes in the company's markets, ensuring that they are conveyed appropriately in the financial statements

In addition, the audit committee discusses with management how any significant activities that it is aware of will be included in the financial statements.

fn 11 For purposes of this example, not all relevant financial statement assertions have been included.

| Prev | Up | Next |

| Home | ||

Copyright © 2013 – 2016 Committee of Sponsoring Organizations of the Treadway Commission and the American Accounting Association. All Rights Reserved. Use of materials is subject to COSO's Policy of Acceptable Use.

To access this page, please login with your COSO credentials using the button below:

Login to COSOPlease enter your COSO login credentials below

Please contact marybeth.gripshover@aaahq.org with any questions