Retraction of articles related to James E. Hunton

The American Accounting Association has retracted 25 articles, and one section of one article, from its journal collection based on: the pattern of misconduct identified in the investigation summary, "Report of Judith A. Malone, Bentley University Ethics Officer, Concerning Dr. James E. Hunton (2014);" the October 2014 supplement to that report; and the coauthors' inability to provide data or other information supporting the existence of primary data, or to confirm that their studies were conducted as described in the published articles. Consistent with the findings in the Bentley University investigation summary, the Association review team found no evidence that Dr. Hunton’s coauthors were aware of or complicit in Dr. Hunton's actions. Click here to view the list of articles.

See you in August!

(The Webmaster does not have back issues of the journal or copies of articles, instruments, scales, etc., so please do not e-mail requests for such items to him. Contact the American Accounting Association or the authors of the article.)

JLTR on the Digital Library

JATA on the Digital Library

The Journal of the American Taxation Association

A journal of the American Taxation Association Section of the American Accounting Association

View/Download Recently Accepted Manuscripts

View/Download Recently Accepted Manuscripts The Journal of the American Taxation Association promotes the study of, and the acquisition of knowledge about, taxation. Dedicated to disseminating a wide variety of tax knowledge with research that employs quantitative, analytical, experimental, and descriptive methods to address tax topics. It prints semi-annually in Spring and Fall, and is indexed in Scopus and ESCI.

Click here to view The Journal of the American Taxation Association Editorial Board. For more information on the journal and the American Taxation Association Section, please click here. For additional journal data and citation analysis, see The Journal of the American Taxation Association Journal Information Packet.

Senior Editor:

Ryan J. Wilson

The Journal of the American Taxation Association

University of Oregon, School of Accounting, Eugene, OR, U.S.A.

E: rwilson3@uoregon.edu

Editorial Office: JATA@aaahq.org

AAA Editorial Assistant:

David Twiddy

P: 941.556.4115

E: david.twiddy@aaahq.org

How to Submit a Manuscript:

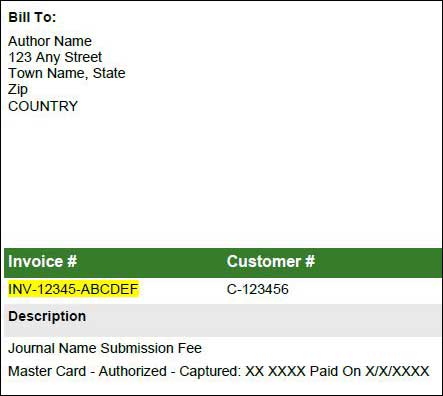

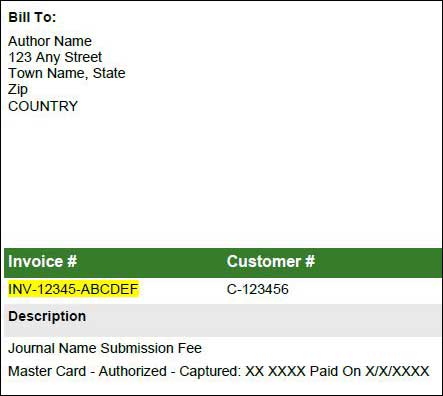

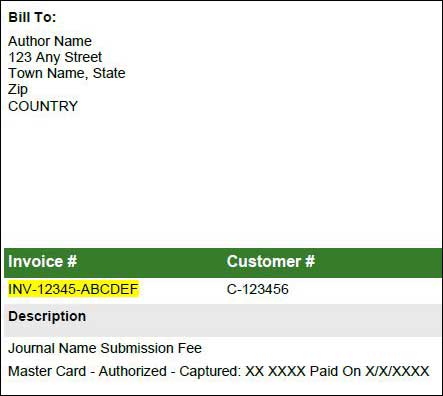

Step 1: Pay submission fee online (VISA, MasterCard, American Express). If you are unable to pay by credit card or have any questions, please contact the AAA Member Services Team at 941.921.7747 or info@aaahq.org. You will need your payment number when submitting to the journal. See the image below to locate the payment number.

Step 2: After you receive your Order Confirmation, read the Editorial Policy and Manuscript Prep Guide to ensure your manuscript is ready for submission.

Step 3: Submit manuscript to the JATA Manuscript Submission System.

Additional Information:

Requests for reprint permission should be directed to the Copyright Clearance Center at www.copyright.com.

The ATA Journal of Legal Tax Research

A journal of the American Taxation Association Section of the American Accounting Association

View/Download Recently Accepted Manuscripts

The ATA Journal of Legal Tax Research publishes creative and innovative studies that employ legal research methodologies. JLTR is online-only and publishes semi-annually, and is indexed in ESCI.

Click here to view Journal of Legal Tax Research Editorial Board. For more information on the journal and the American Taxation Association Section, please click here. For additional journal data and citation analysis, see The ATA Journal of Legal Tax Research Journal Information Packet.

Editor:

Blaise M. Sonnier

University of Colorado Colorado Springs

College of Business, Department of Accounting and Finance, Colorado Springs, CO, USA

P: 719.255.5143

E: bsonnier@uccs.edu

Editorial Office: JLTR@aaahq.org

AAA Publications Assistant:

David Twiddy

P: 941.556.4115

E: david.twiddy@aaahq.org

How to Submit a Manuscript:

Step 1: Pay submission fee online (VISA, MasterCard, American Express). If you are unable to pay by credit card or have any questions, please contact the AAA Member Services Team at 941.921.7747 or info@aaahq.org. You will need your payment number when submitting to the journal. See the image below to locate the payment number.

Step 2: After you receive your Order Confirmation, read the Editorial Policy and Manuscript Prep Guide to ensure your manuscript is ready for submission.

Step 3: Submit manuscript to the JLTR Manuscript Submission System .

Additional Information:

Requests for reprint permission should be directed to the Copyright Clearance Center at www.copyright.com.

All newsletters are in pdf format

Current Issue: 2014 Fall

Past Issues:

| 2014 | Spring | Fall |

| | | |

| 2013 | Spring | Fall |

| | | |

| 2012 | Spring | Fall |

| | | |

| 2011 | Spring | Fall |

| | | |

| 2010 | n/a | Fall |

| | | |

| 2009 | n/a | n/a |

| | | |

| 2008 | n/a | n/a |

| | | |

| 2007 | Spring/Summer | Fall/Winter |

| | | | | |

| 2006 | Spring | Summer | Fall | |

| | | | | |

| 2005 | Spring | Summer | Fall | |

| | | | | |

| 2004 | Spring | Summer | Fall | |

| | | | | |

| 2003 | Spring | Summer | Fall | |

| | | | | |

| 2002 | Spring | Summer | Fall | |

| | | | | |

| 2001 | Spring | Summer | Fall | |

| | | | | |

| 2000 | Spring | Summer | Fall | |

| | | | | |

| 1999 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1998 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1997 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1996 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1995 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1994 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1993 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1992 | Spring | Summer | Fall, part 1 | Fall, part 2 |

| | | | | |

| 1991 | Spring | Summer | Fall | |

| | | | | |

| 1990 | Spring | Summer | Fall | |

| | | | | |

| 1989 | Spring | Summer | Fall | |

| | | | | |

| 1988 | Spring | Summer | Fall | |

| | | | | |

| 1987 | Winter | Summer | Fall | |

| | | | | |

| 1986 | Winter | Summer | Fall | |

| | | | | |

| 1985 | Winter | Summer | Fall | |

| | | | | |

| 1984 | Summer | Fall | | |

| | | | | |

| 1983 | Winter | Spring | Fall | Late Winter |

| | | | | |

| 1982 | Spring | | | |

| | | | | |

| 1981 | January | April | June | Fall |

| | | | | |

| 1980 | February | June | | |

| | | | | |

| 1979 | Winter | Summer | | |

| | | |

| 1978 | Spring | Fall |